Why Fealthy?

Before

I am afraid to open the banking app.

After

I calmly open the app.

Before

Everyone says — you need to invest. But how?

After

I confidently start investing.

Before

I keep a budget... But it doesn't change anything

After

My budget is my tool

Before

Money is stress, not freedom

After

Money is about choice, not stress

Before

I want to live better — but where to start?

After

I take my first steps confidently

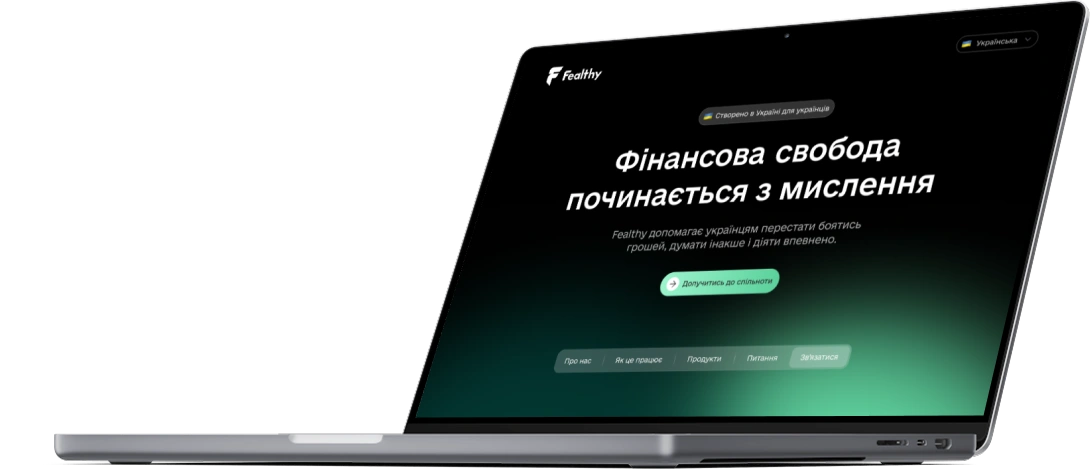

We are a Ukrainian fintech product with a human vibe.

We aim to change the approach to finance by providing you with tools for real control and growth.

We're not just about money. We're about mindset.

Fealthy develops a culture of conscious attitude to finance. No pressure. No advertising. Without fear. We believe that financial confidence is a right, not a privilege.

What we want to change

Thinking is better than being afraid

We see a future where people are not afraid of finances, but understand them. Where the budget is not a burden, but a tool. Where financial literacy is not a course, but a way of thinking. We want Ukrainians to make decisions not with anxiety, but with knowledge.

Our social role

Between numbers and meaning, we're there for you

Fealthy is about support. We are there when you are afraid to open the bank's app. We are there when most platforms are silent: between numbers and meaning, between “for the sake of saving” and “for the sake of life.”.

Independence

Freedom to build our own - because we believe in it

We finance ourselves - this gives us the freedom to build what we believe in. We do not promote loans or risky investments. Our goal is not traffic, but transformation of thinking.

Fealthy

We don't impose rules - we provide tools. This is not just another banking interface or boring spreadsheet.

01

-

04

Not a bank. Not an accounting office

We don't impose rules - we provide tools. This is not just another banking interface or boring spreadsheet. This is a personal space where you decide what your financial confidence looks like.

Development of financial thinking

Not just “count”, but “understand”. We do not provide magic buttons. Instead, we help you see the connections, draw conclusions, and change your habits. Because control is not about numbers, it's about thinking

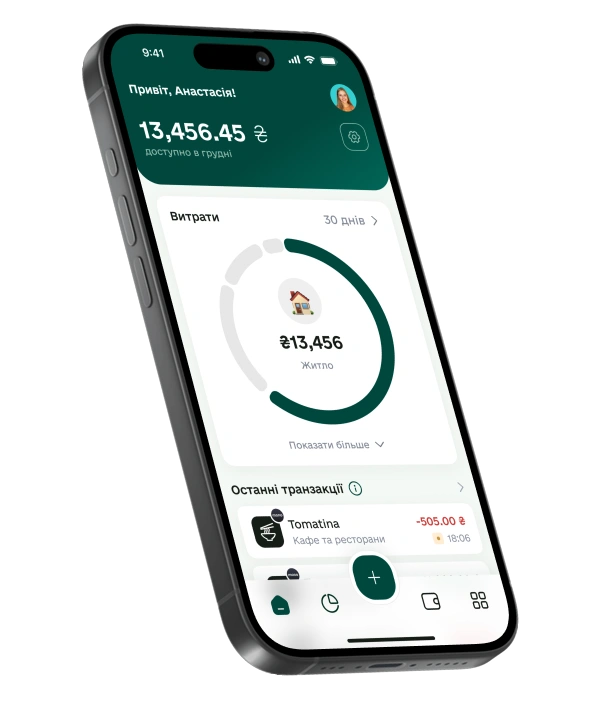

Intuitive, clear, modern

Not a single unnecessary button. Only what you need. Instead of overloaded screens, we offer a lightweight experience, clear words, and natural scenarios. We build logic that speaks the language of the user, not the financier.

Mobility and transparency

You always know where your money is and what's going on with it. Fealthy is designed to be with you - on the road, at coffee, between jobs. Quick access, transparent display, nothing superfluous. Easy to find. Easy to understand. Easy to understand.

A community of people who want to grow

Frequently asked questions

What is Fealthy?

01

Fealthy is neither a bank nor an accounting service. It's a mobile app that helps you develop your financial thinking, understand your spending, and achieve your financial goals - without pressure or unnecessary complexity.

How is Fealthy different from other financial apps?

02

We don't just track numbers - we help you understand your financial behavior. Fealthy focuses on developing financial thinking, not just accounting. We provide tools for awareness and growth, without imposing rules or promoting risky financial products.

Do I need to have any special knowledge to use Fealthy?

03

No. Fealthy is designed for people who want to gain control of their finances, regardless of their current level of knowledge. The interface is intuitive, the language is simple, and the logic is built around your real needs, not complex financial terms.

How does Fealthy help me manage my money if I'm constantly stressed about finances?

04

Fealthy helps you see where your money goes and understand what you can afford. Instead of fear and uncertainty, you get clarity and control. This removes the stress of the unknown and gives you confidence in your financial decisions.

Is it free?

05

Fealthy offers both free and premium features. The basic functionality for expense tracking and budget management is available for free. Premium features provide additional tools for deeper financial analysis and planning.